The global Automotive Industry is a cornerstone of the modern economy, driving innovation in manufacturing, logistics, and finance. However, owning and maintaining a vehicle involves navigating a complex web of Auto Insurance Policies, mechanical warranties, and safety regulations. Whether you are a fleet manager or a daily commuter, the ability to diagnose mechanical issues early—literally “spotting the difference” in your car’s performance—is crucial for safety and financial solvency.

This article explores the science of Mechanical Engineering, the rising costs of car repairs, and how the insurance industry assesses risk based on vehicle maintenance.

1. The Science of Automotive Diagnostics

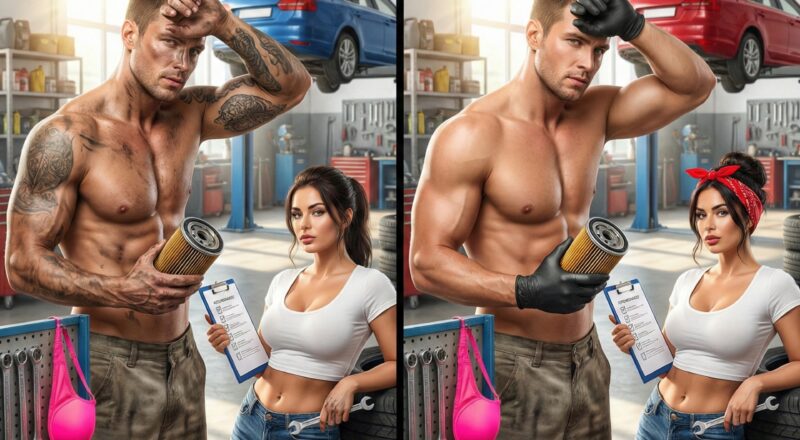

In the puzzle, the mechanic is inspecting an oil filter. This routine task represents the foundation of vehicle longevity.

Preventative Maintenance: Ignoring an oil change can lead to catastrophic engine failure. Mechanical Engineers design engines with tight tolerances; dirty oil acts as an abrasive, destroying pistons and bearings. The cost of a $50 oil change versus a $5,000 engine replacement is the ultimate lesson in risk management.

OBD-II Diagnostics: Modern cars are computers on wheels. When a “Check Engine” light comes on, technicians use OBD-II Scanners to read error codes. These digital tools allow mechanics to spot differences in fuel mixture, sensor voltage, or transmission pressure that the human eye cannot see.

2. Auto Insurance and Accident Liability

The difference in the car color (Difference #3) highlights the diversity of vehicles on the road, all of which require coverage.

Collision vs. Comprehensive: Understanding your policy is vital. Collision Insurance covers damage from accidents, while Comprehensive Insurance covers theft, weather, or vandalism. Many drivers mistakenly believe “Full Coverage” means they pay nothing, not realizing that high deductibles still apply.

Liability Coverage: If a mechanic fails to tighten a lug nut (implied by the wrench difference), and a wheel comes off causing an accident, who is liable? Garage Liability Insurance protects auto shops from lawsuits arising from faulty workmanship. Personal Injury Lawyers specialize in these “Negligence Claims,” seeking damages for victims of mechanical failure.

[attachment_0](attachment)3. Supply Chain and Auto Parts Market

The stack of tires in the image represents the massive global supply chain of auto parts.

OEM vs. Aftermarket Parts: When repairing a car, insurers often push for “Aftermarket Parts” (generic) to save money, while owners prefer “Original Equipment Manufacturer” (OEM) parts. The difference in quality can be significant. Consumer Protection Laws in some states guarantee the right to choose OEM parts, but policyholders must often fight for this.

Just-in-Time Inventory: Auto shops rely on rapid delivery of parts. A delay in shipping a specific sensor can leave a car stranded on a lift for weeks, costing the owner in rental car fees and lost productivity.

4. The Rise of Electric Vehicles (EVs)

The automotive landscape is shifting toward electrification.

EV Maintenance: Electric Vehicles require less maintenance (no oil changes), but the repairs they do need are more expensive. Battery replacement can cost upwards of $15,000. High-Voltage Safety Training is now mandatory for mechanics working on EVs to prevent electrocution.

Insurance for EVs: Insuring a Tesla or Rivian is often more expensive than a gas car due to higher repair costs and the scarcity of qualified technicians. Actuaries are still adjusting risk models to account for this new technology.

5. Workplace Safety in Auto Repair

The difference in the gloves (Difference #1) is a major safety indicator.

Chemical Hazards: Mechanics are exposed to carcinogens like used oil, brake dust (asbestos), and solvents. Wearing Personal Protective Equipment (PPE) like nitrile gloves is essential to prevent long-term health issues like dermatitis or cancer.

Physical Hazards: Auto shops are full of crushing hazards (lifts), slip hazards (oil spills), and noise hazards. OSHA Regulations mandate strict protocols. A shop that ignores these (like a mechanic working without gloves) is a liability lawsuit waiting to happen.

6. Fleet Management and Logistics

For businesses, vehicles are revenue-generating assets.

Fleet Telematics: Companies use GPS tracking and telematics to monitor driver behavior. They “spot the difference” between a safe driver and a reckless one by analyzing braking patterns and speed. This data is used to lower commercial insurance premiums.

Total Cost of Ownership (TCO): Fleet managers calculate TCO by factoring in depreciation, fuel, insurance, and maintenance. Keeping older vehicles (like the one in the puzzle) running is often a balancing act between repair costs and the capital expense of buying new trucks.

7. Consumer Rights and Lemon Laws

What happens when a car can’t be fixed?

Lemon Laws: If a new vehicle has a substantial defect that cannot be repaired after a reasonable number of attempts, “Lemon Laws” require the manufacturer to buy it back. This protects consumers from being stuck with a “Monday Morning Car” (a car built poorly).

Warranty Disputes: Manufacturers often try to void warranties if the owner cannot prove they performed regular maintenance. Keeping detailed records (like the checklist on the clipboard in the image) is the best defense against a denied warranty claim.

Conclusion: The Mechanics of Wealth

A car is often the second largest purchase a person makes. Treating it with the same financial rigor as a home investment is smart money management. Whether it is choosing the right insurance deductible or finding an honest mechanic, attention to detail is your best tool.

By training your eye to spot the differences in this garage, you are practicing the vigilance needed to keep your own wheels turning safely and affordably.

Scroll back up to the image. Did you check the tires? Did you see the gloves? Maintenance is cheaper than repair.